BUSINESS OWNERS & ENTREPRENEURS

$50K+ TO $250K AT 0% APR

FUNDING FOR YOUR BUSINESS

With a Guaranteed Funding Strategy, running your business becomes effortless, because you have a cash flow that works FOR you and not against you.

Answer a few quick questions and let's hop on a call... (Just Click the Button Below)

DOES BIG FAITH CAPITAL

ACTUALLY WORK?

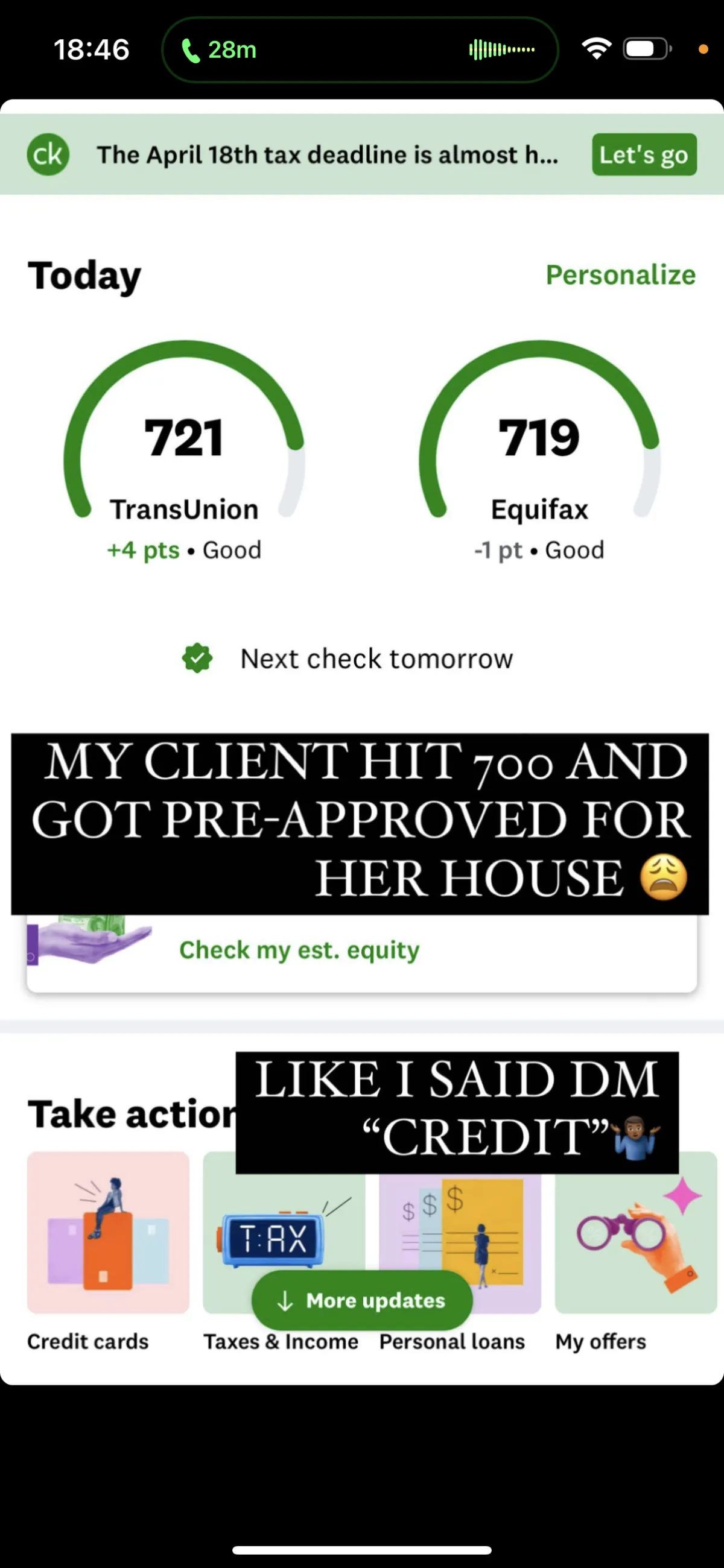

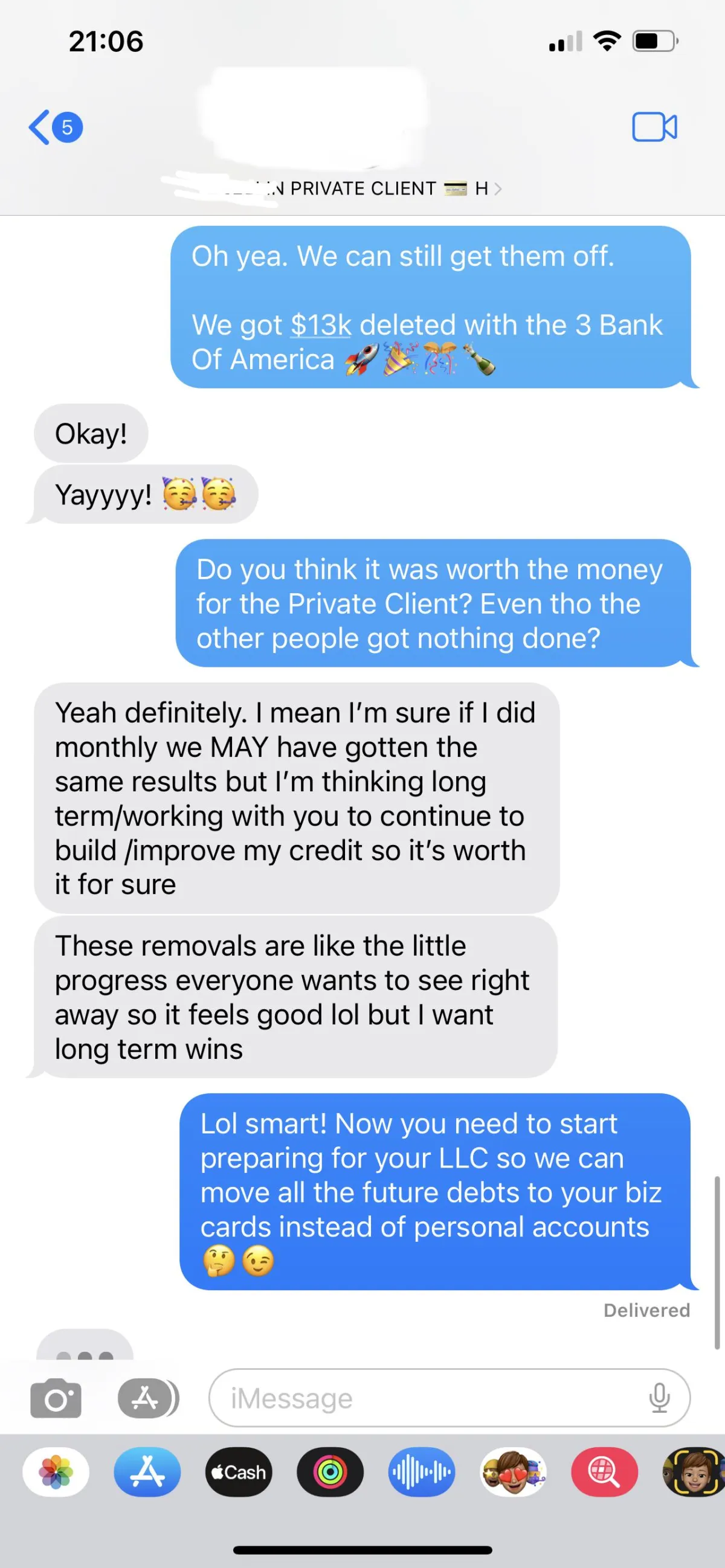

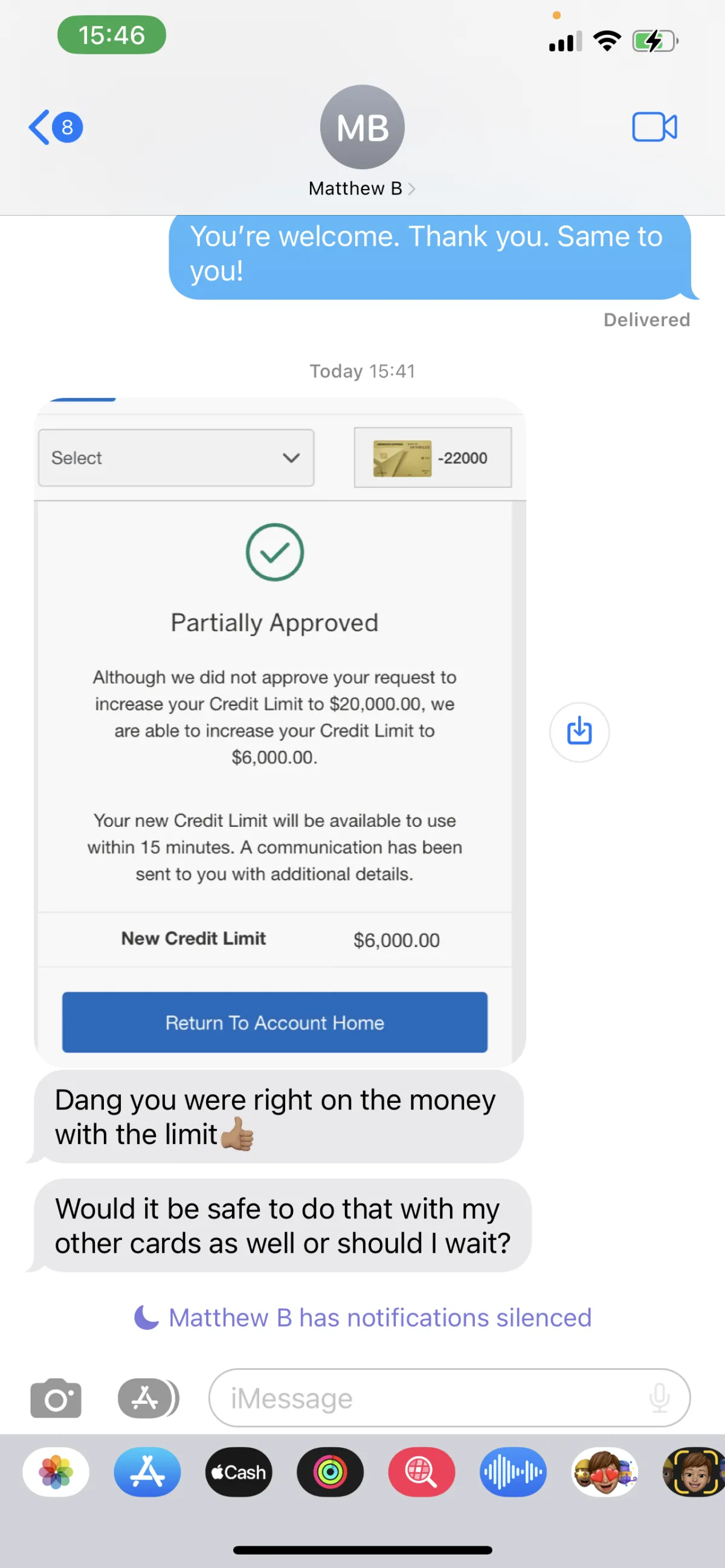

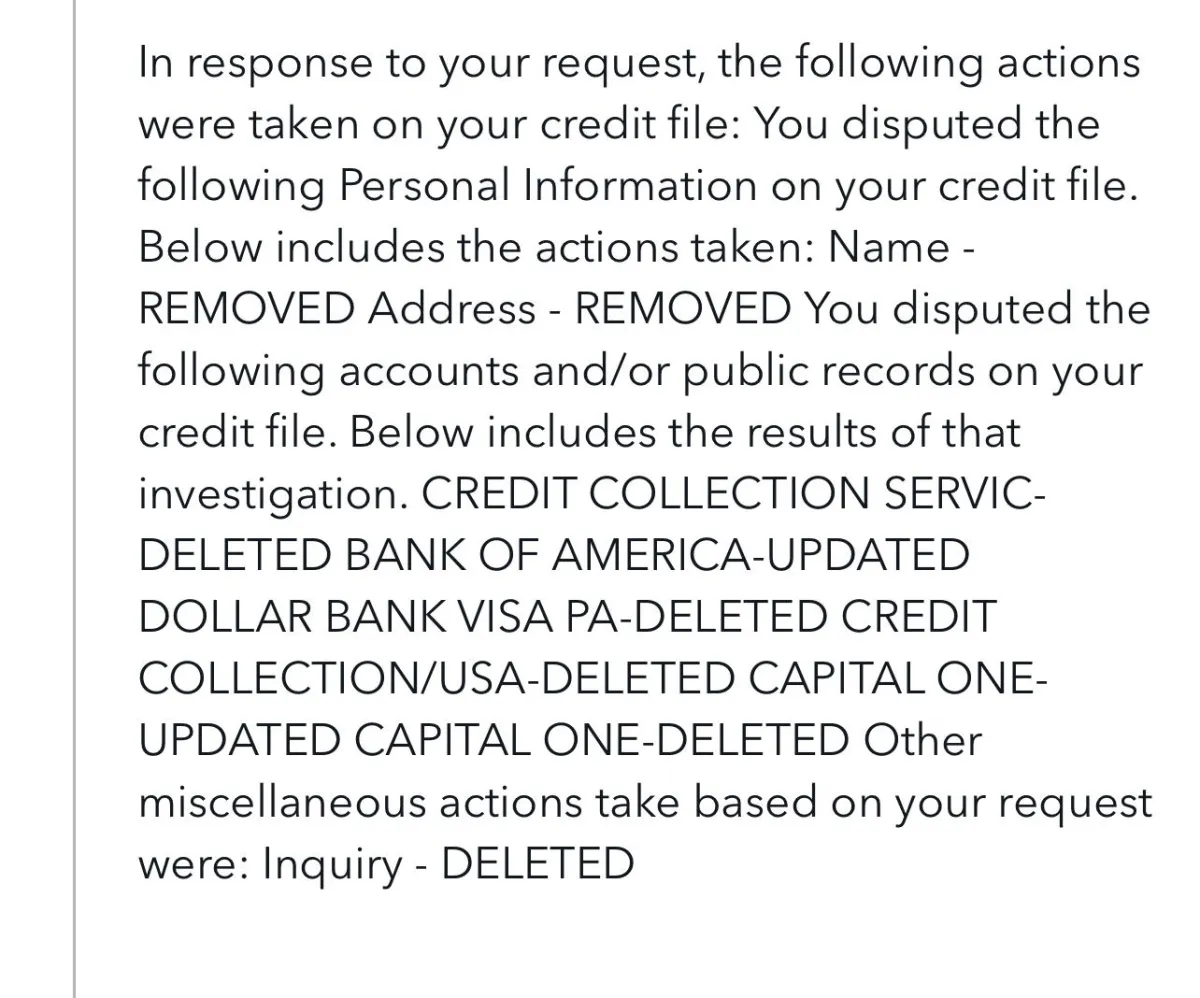

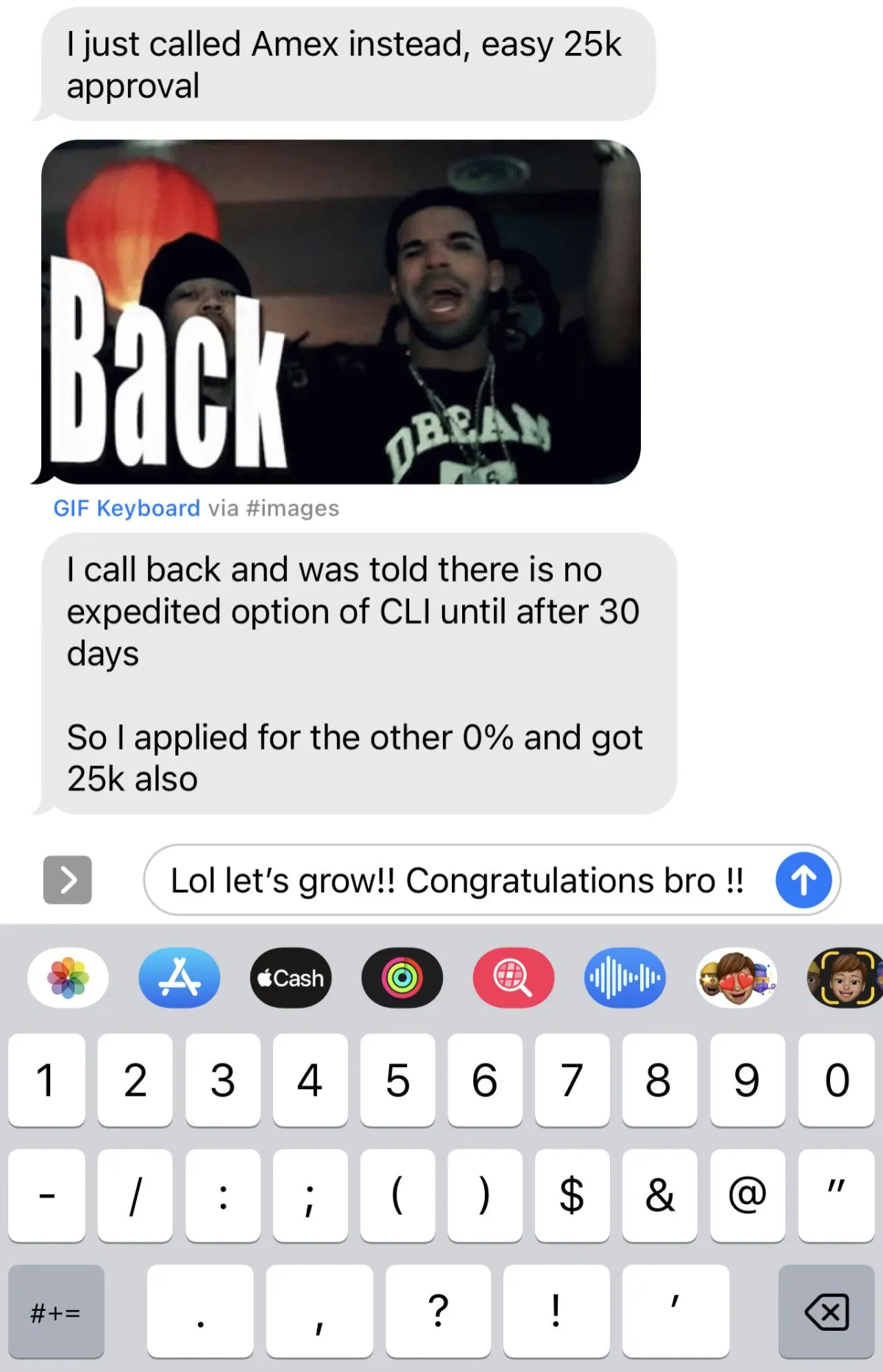

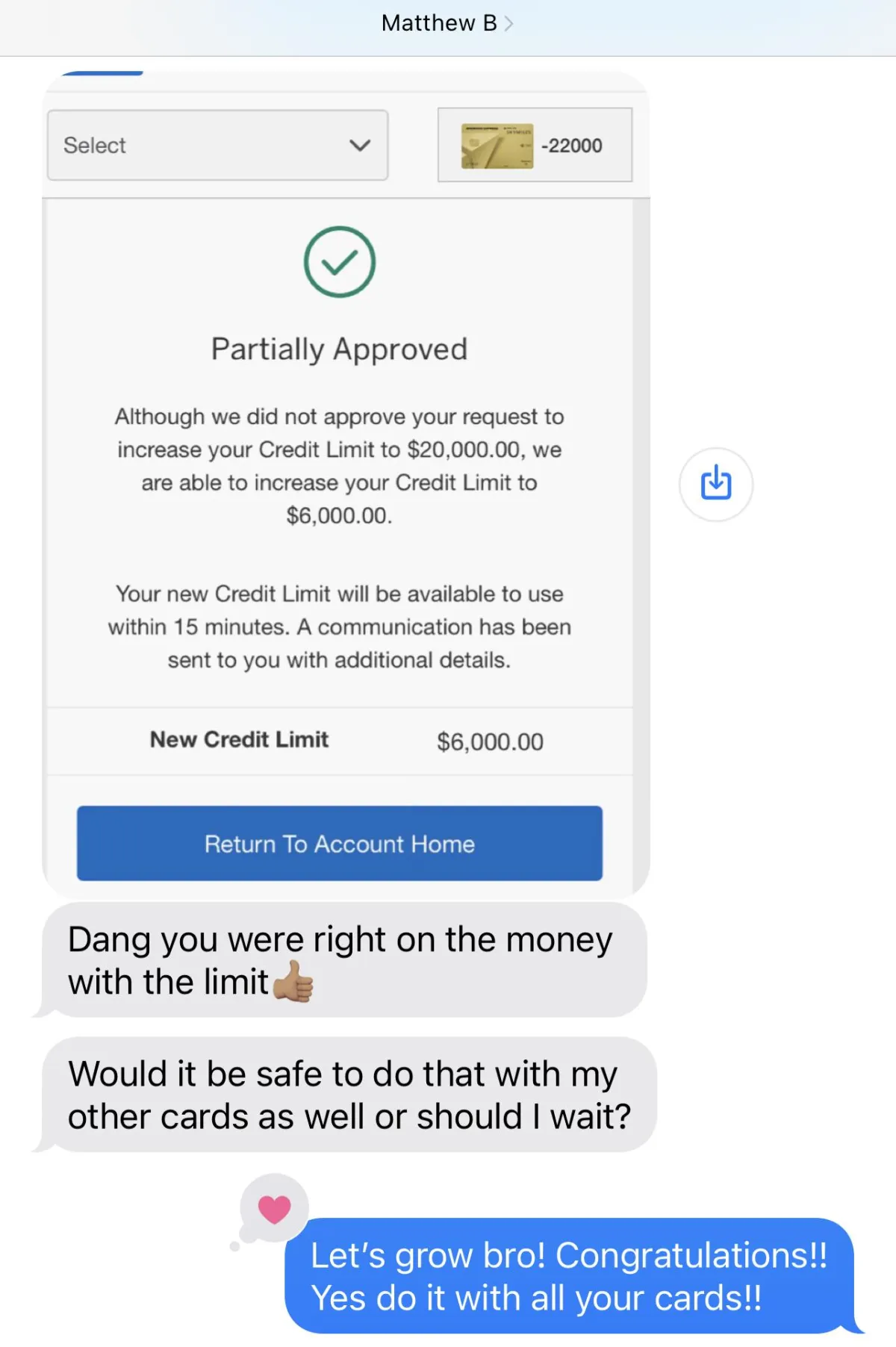

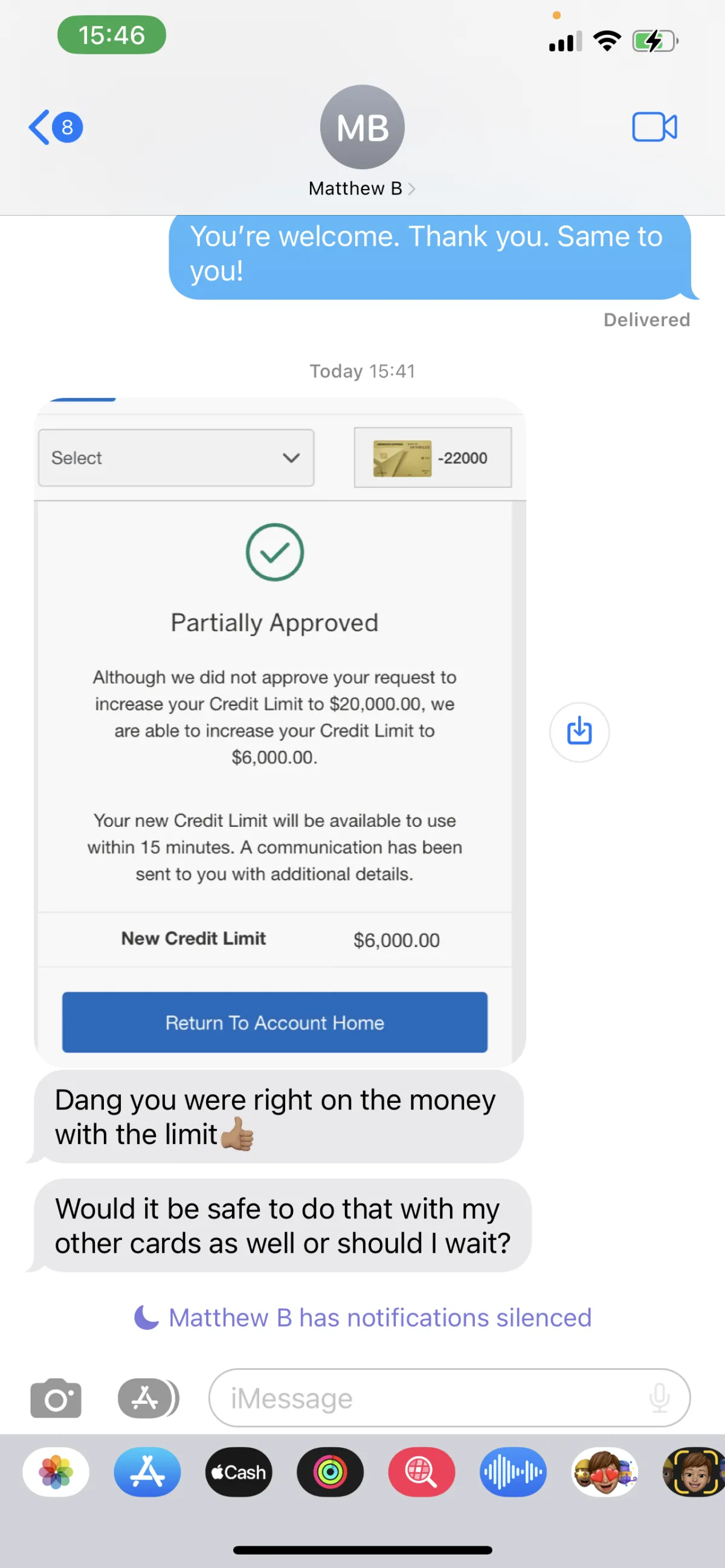

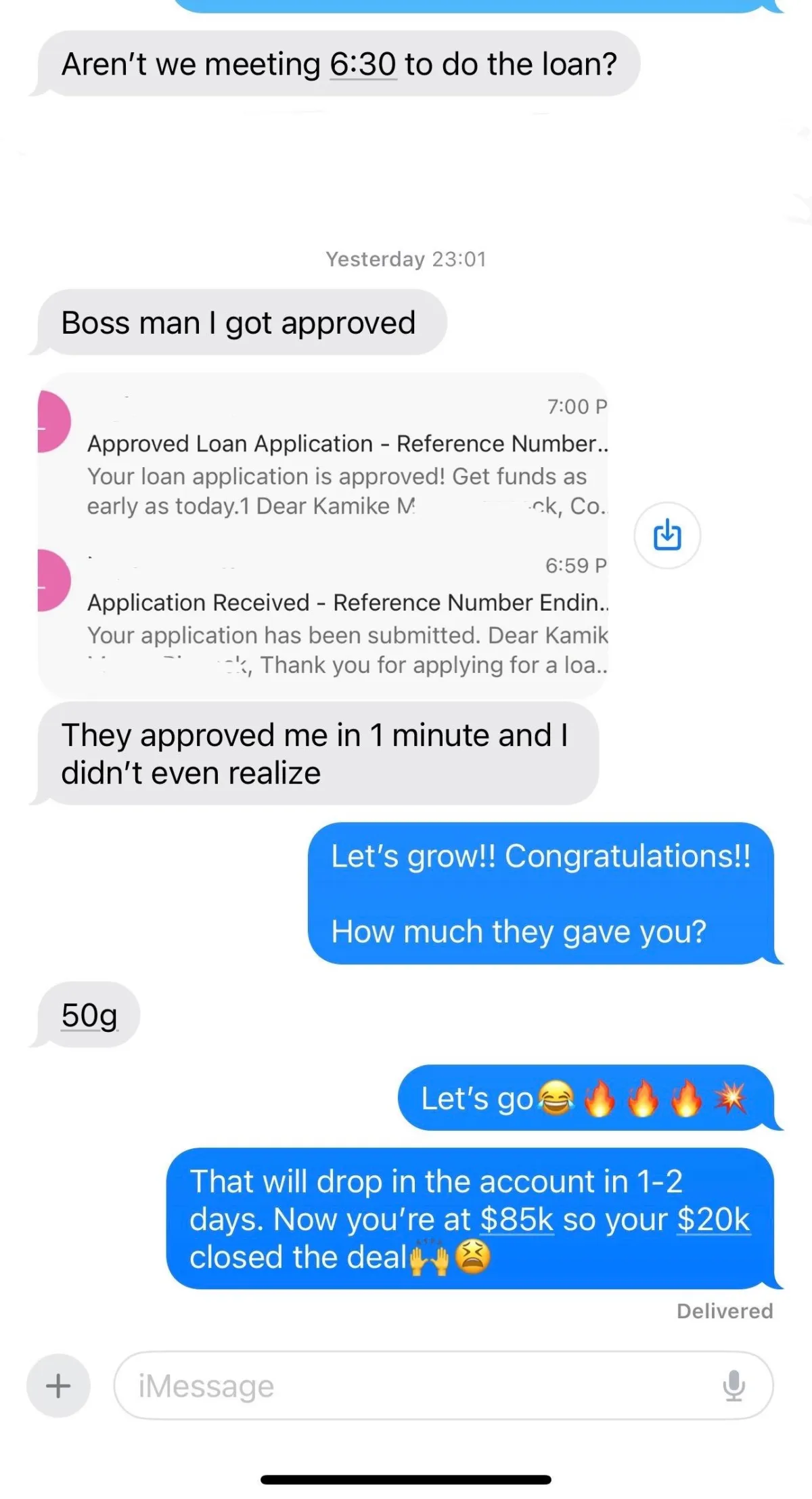

Matthew Borg

Borg Rider

Niche: Motorcycle Repairs

Result: $75,000 in 62 days

Matthew's Success Story: Securing $75K at 0% APR in Just 62 Days with a 2-Year-Old Personal Credit Profile!

Matthew found himself facing challenges in building his personal credit and was unaware of the potential of business credit. Operating his day-to-day operations solely with cash, he realized it was limiting the growth of his business.

The Process

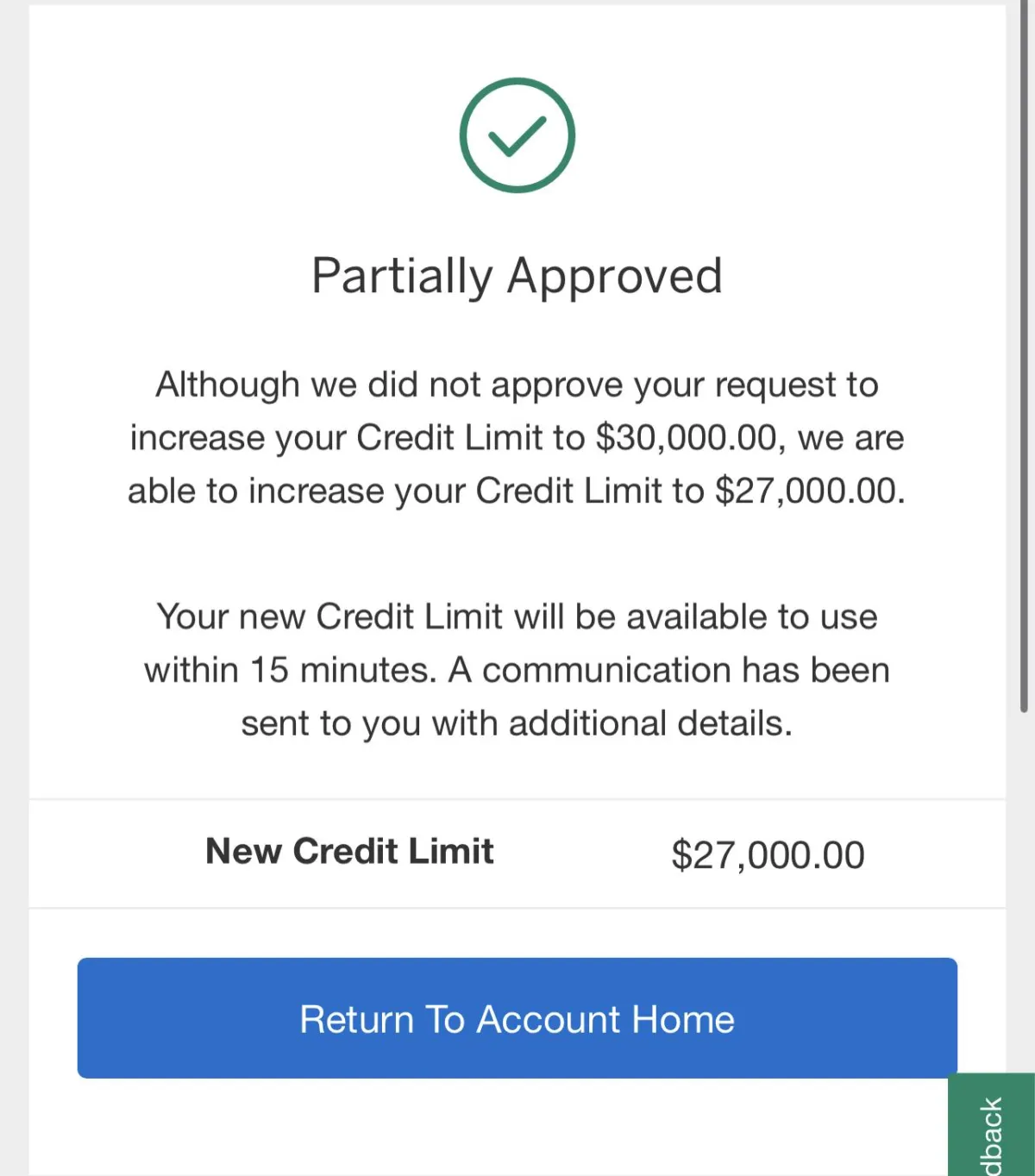

In the initial stages of working with Matthew, we provided step-by-step guidance on enhancing his personal credit profile to maximize approval odds. This included adding authorized users (AU) to boost credit history, incorporating various accounts to diversify his credit mix, and ultimately successfully applying for business credit cards.

The Result

We successfully secured $75,000 in 0% APR business credit for him, even with a relatively new personal credit profile. Now, he is prepared to separate his business from his personal finances, equipped with the cash flow needed to invest in inventory and drive his business forward.

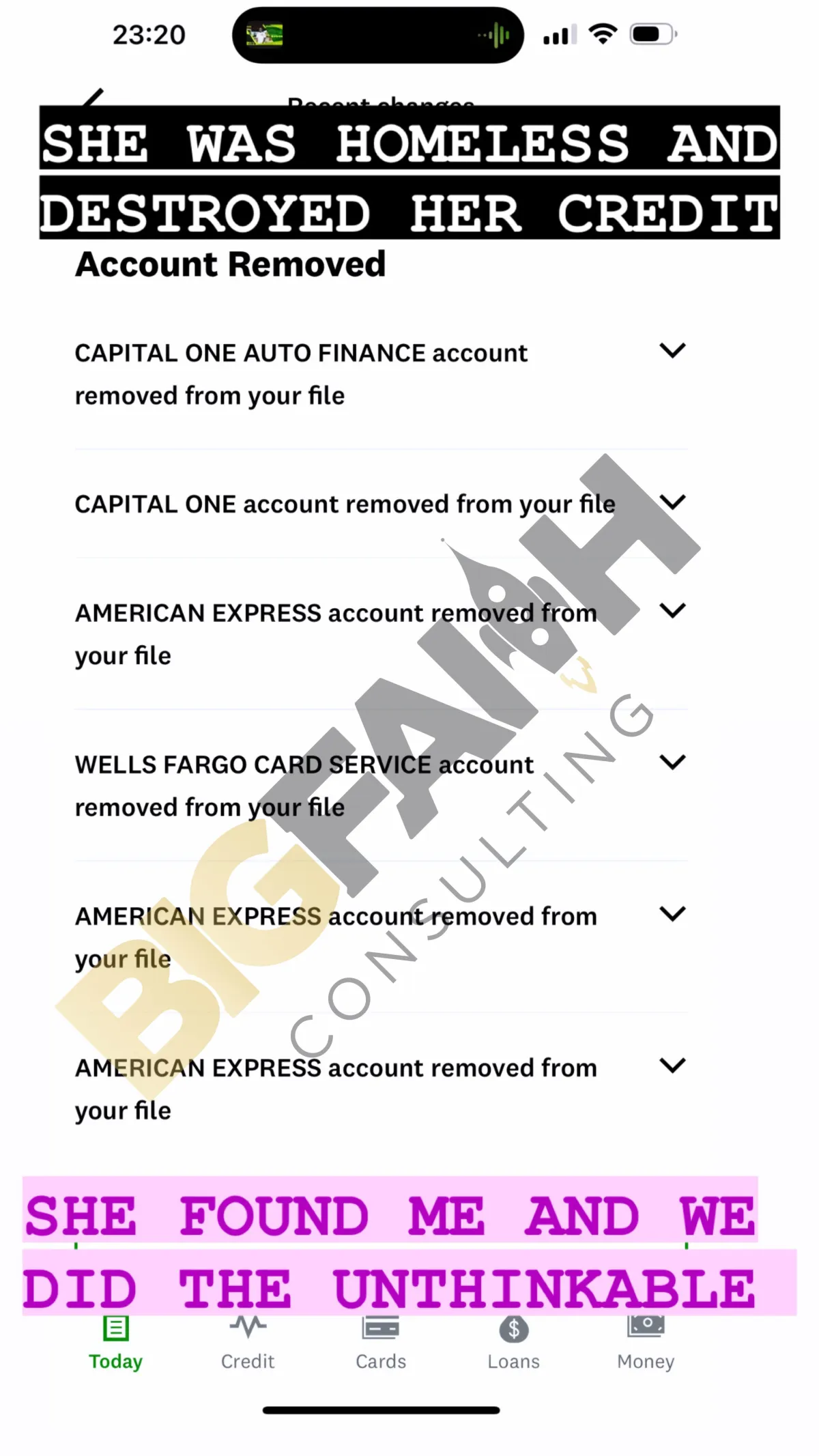

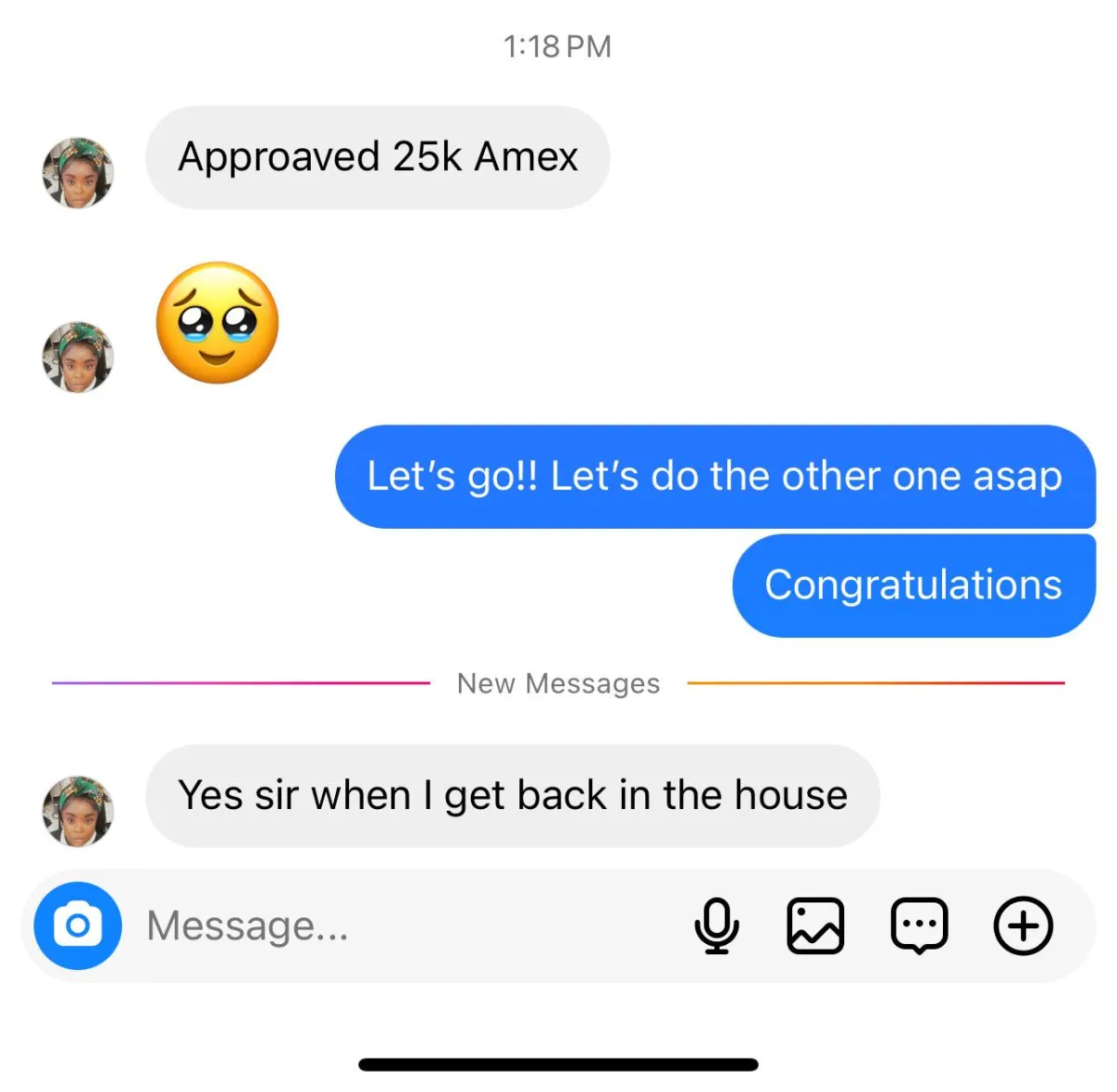

Jennifer Prouse

Body Treats

Niche: Hair Salon

Result: $100,000 in 3 weeks

Body Treats : Jennifer Secures $100K Funding in Just 3 Weeks

When Jennifer approached us about Body Treats, she had been delving deep into her personal reserves, occasionally tapping into her savings to restock inventory for her beauty venture. Jennifer recognized that continuing on this path would keep her dreams of business expansion on hold.

The Process

Upon initiation, Jennifer's primary request was clear: 'I just need funding to manage the initial expenses without depleting my own account.' While confident in generating revenue for repayment through client bookings, she aimed to break free from the cycle of risking personal savings.

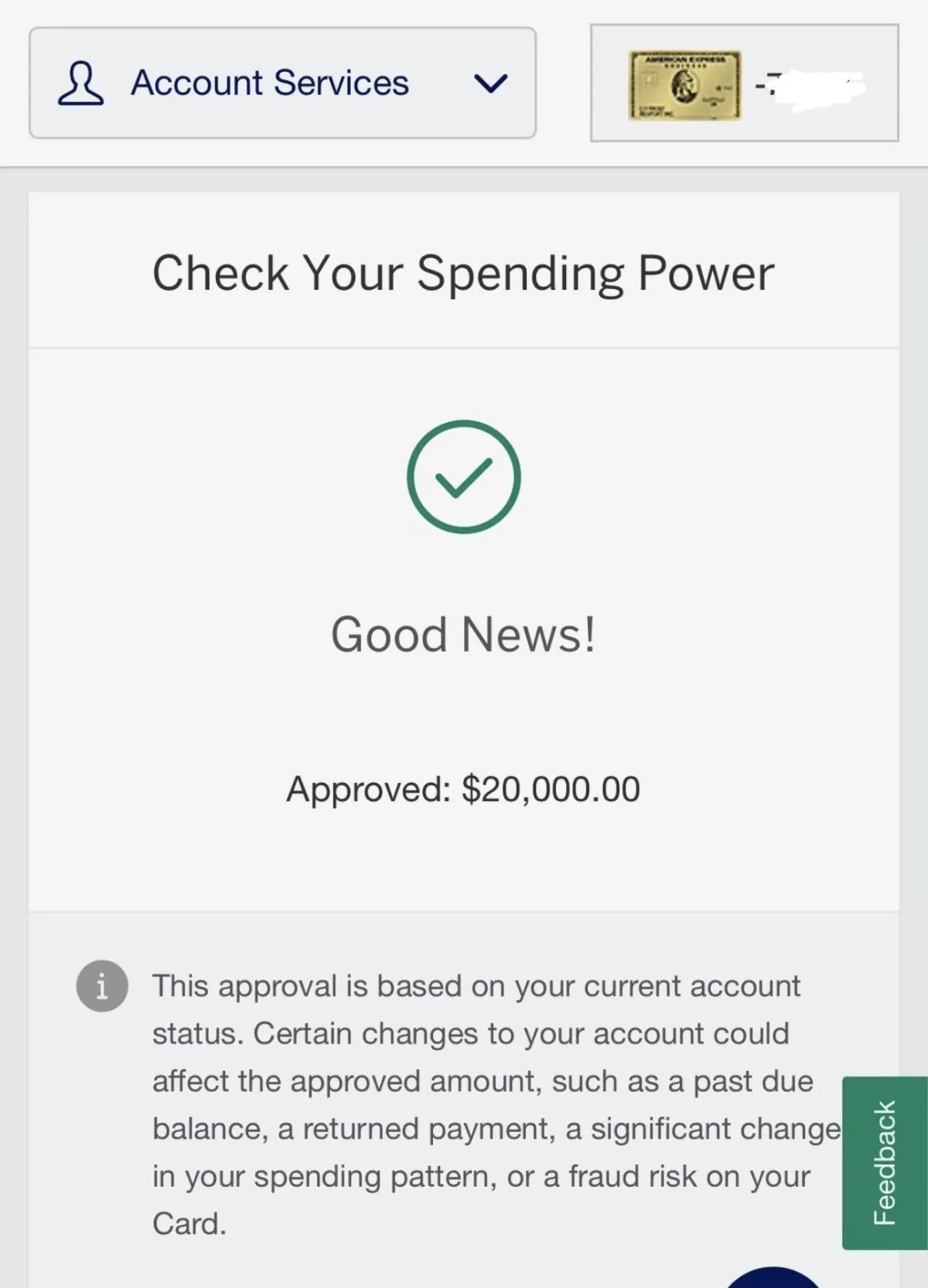

Body Treats conducted a thorough assessment of her financial standing and crafted a comprehensive, personalized strategy. Subsequently, Jennifer received approvals for a combined amount of $100,000 across three credit cards.

The Result

Jennifer's financial boost empowered her to use a credit card for routine expenditures. This not only allowed her to accumulate reward points and cashback but also provided the flexibility to market her products without the stress of immediate cash outflow.

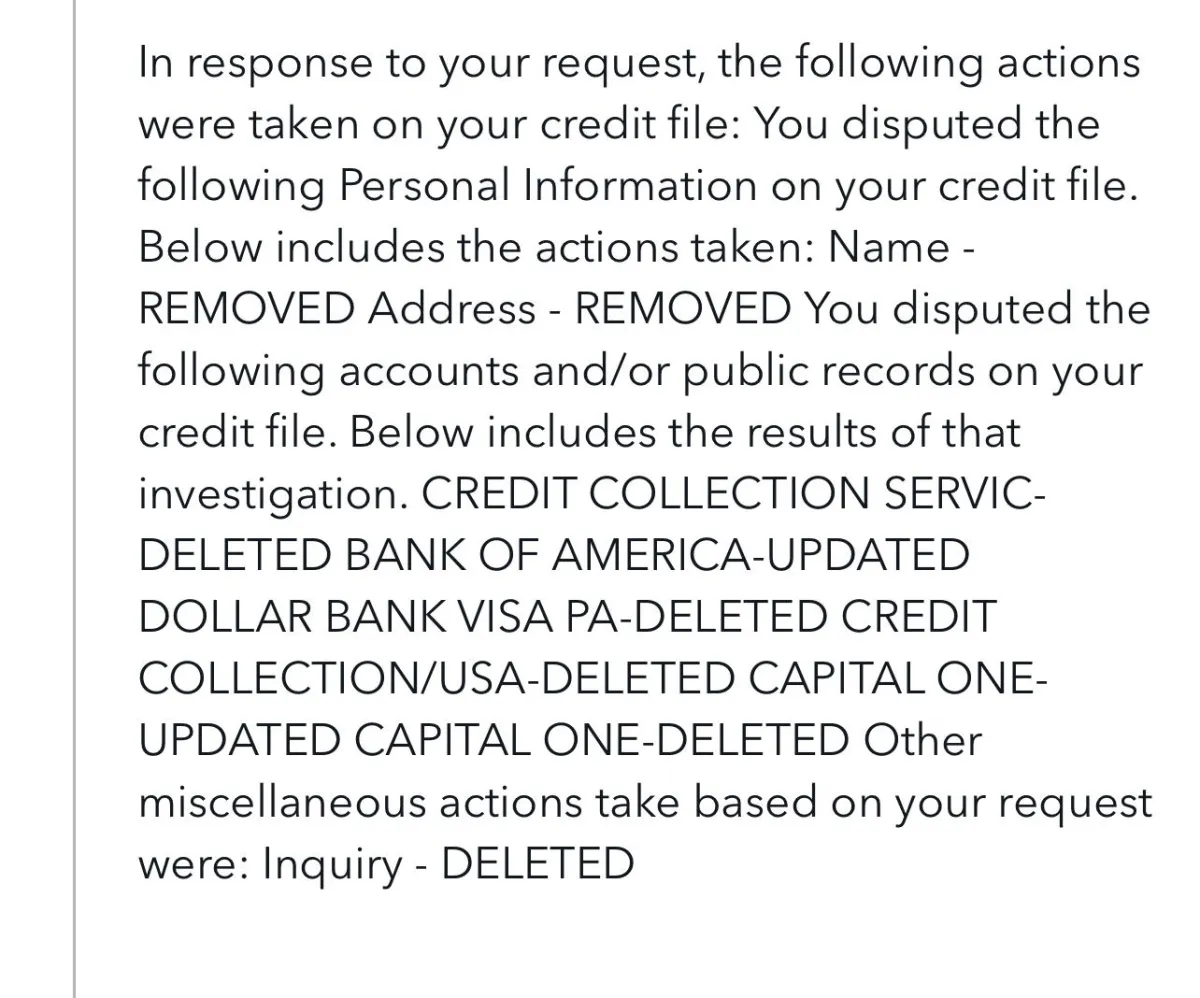

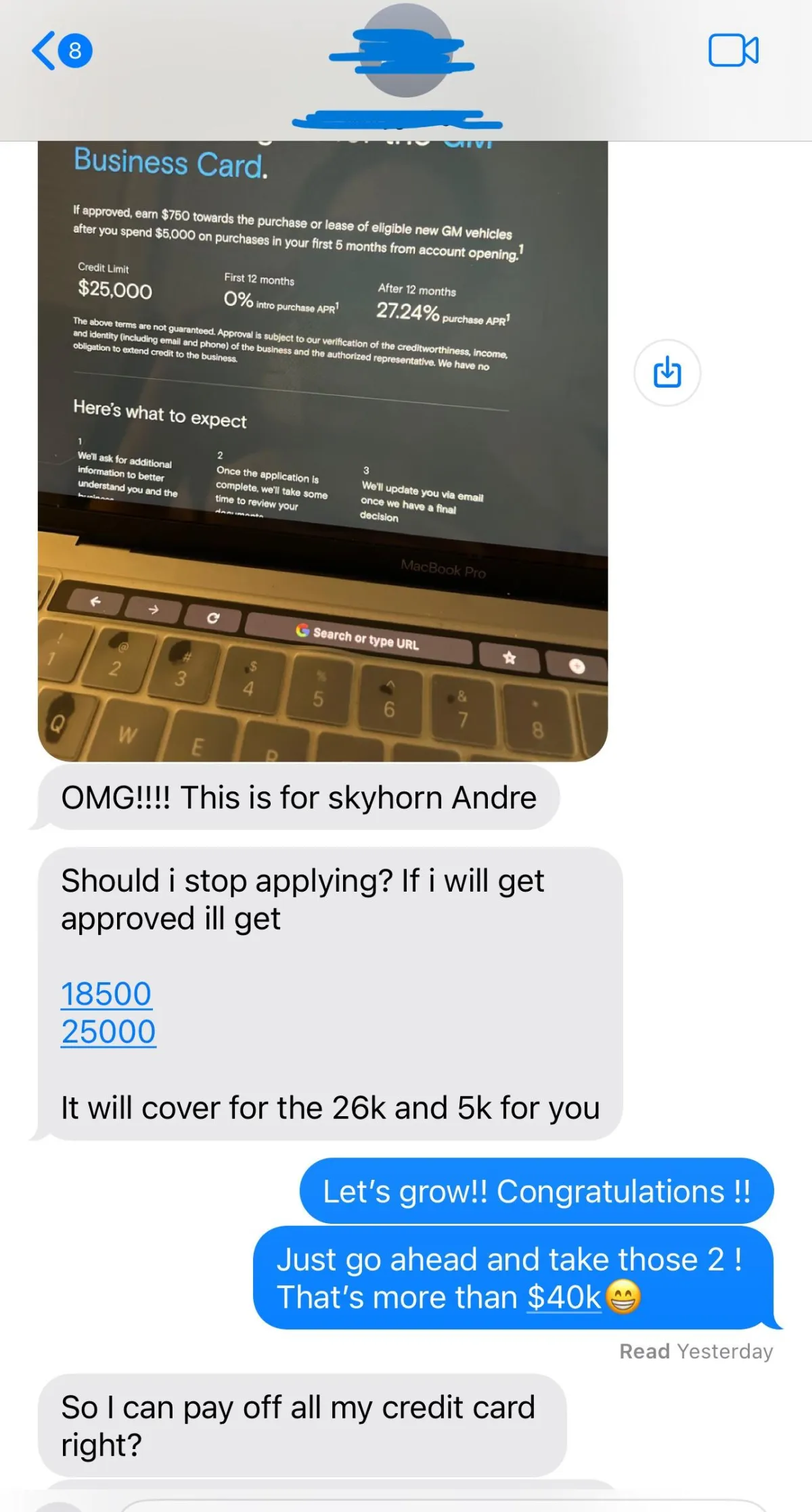

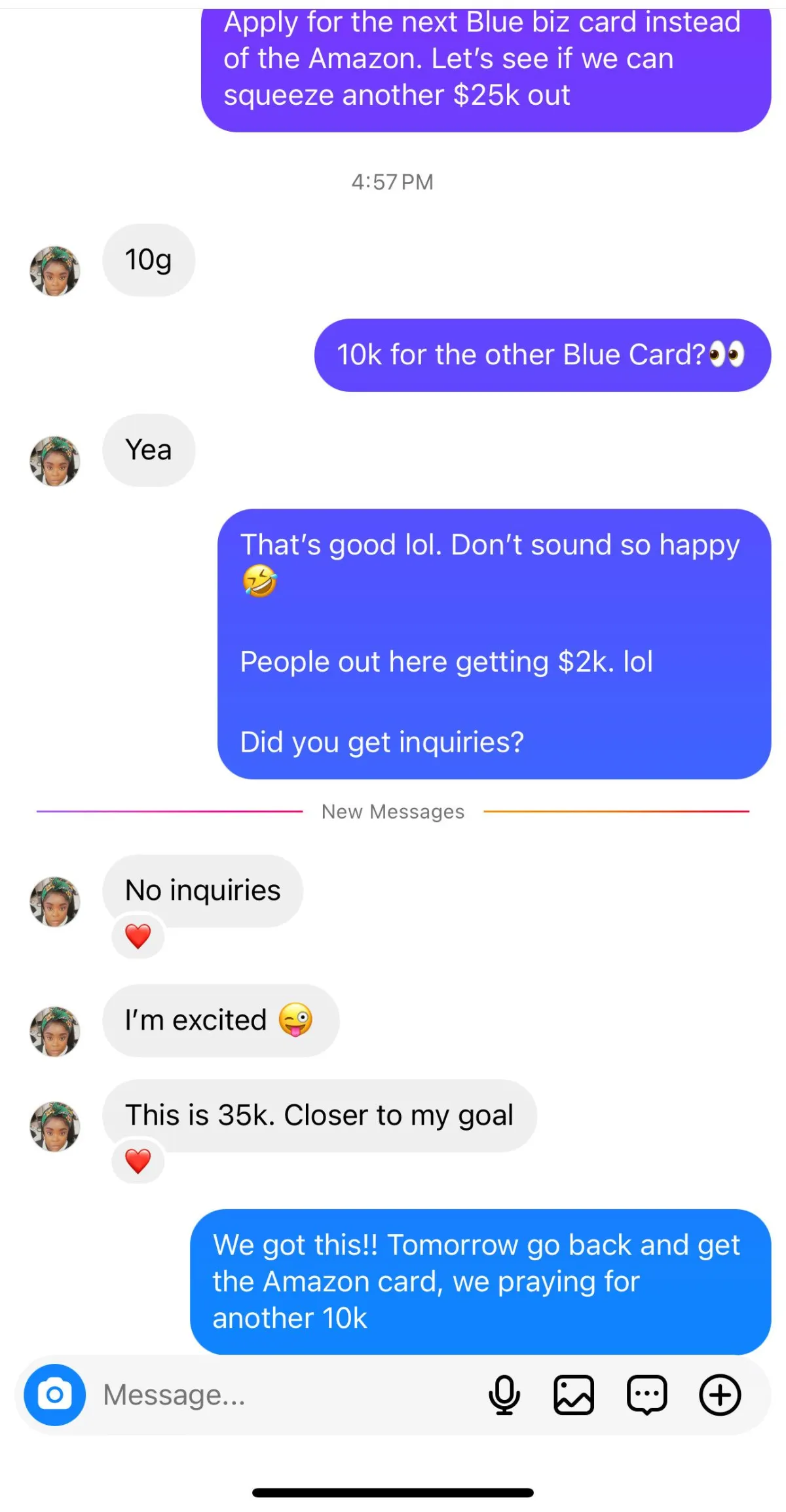

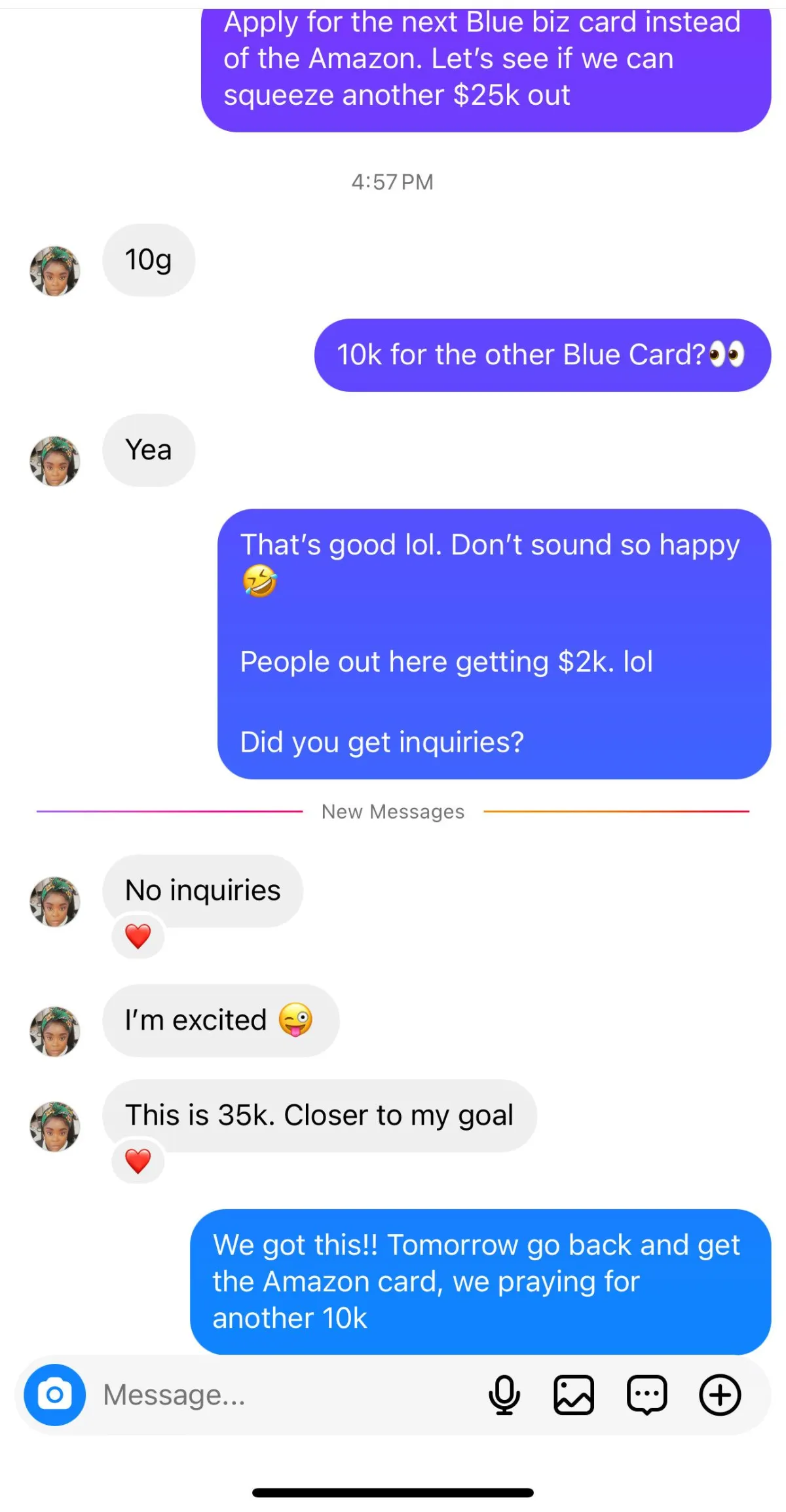

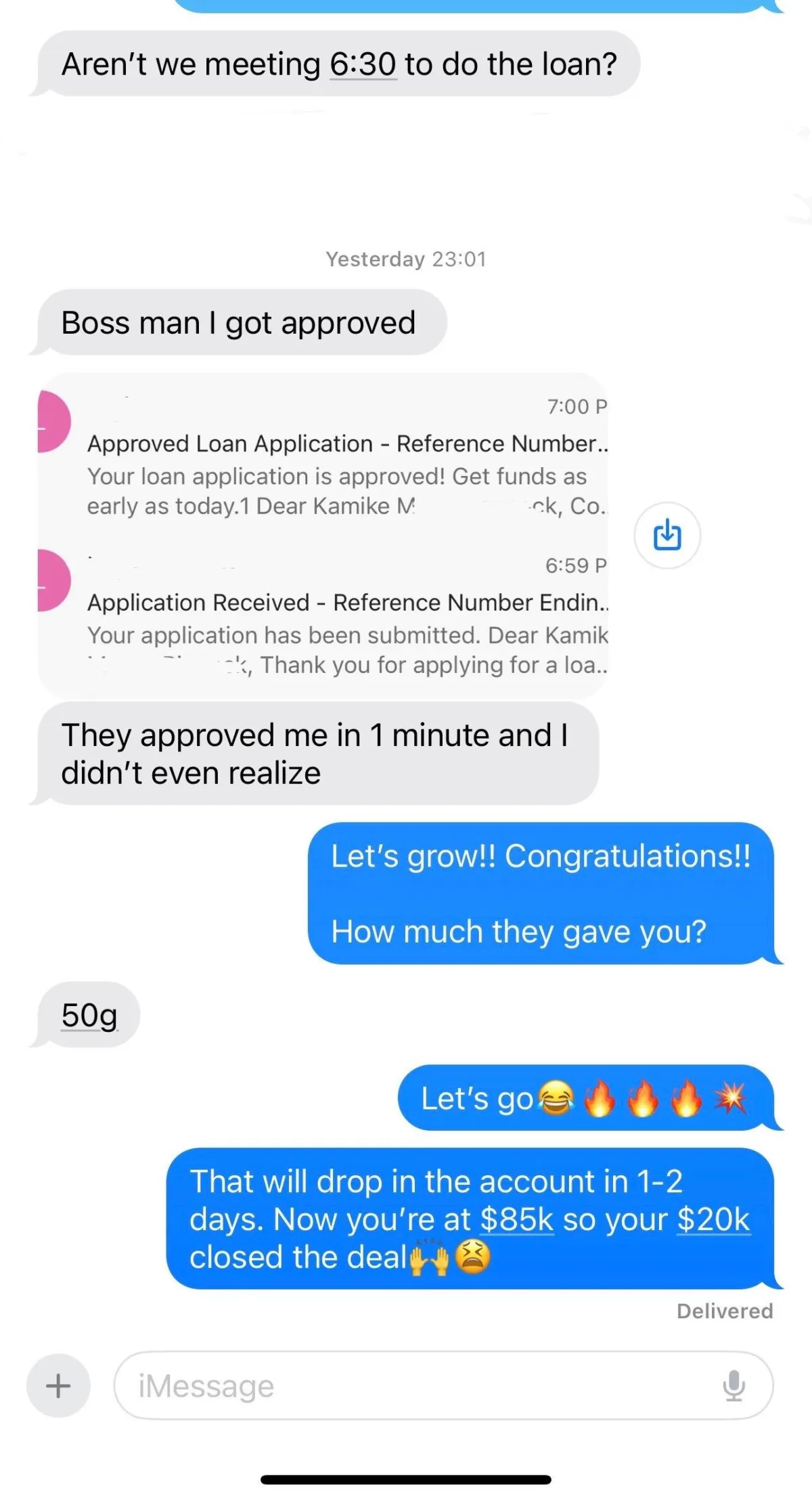

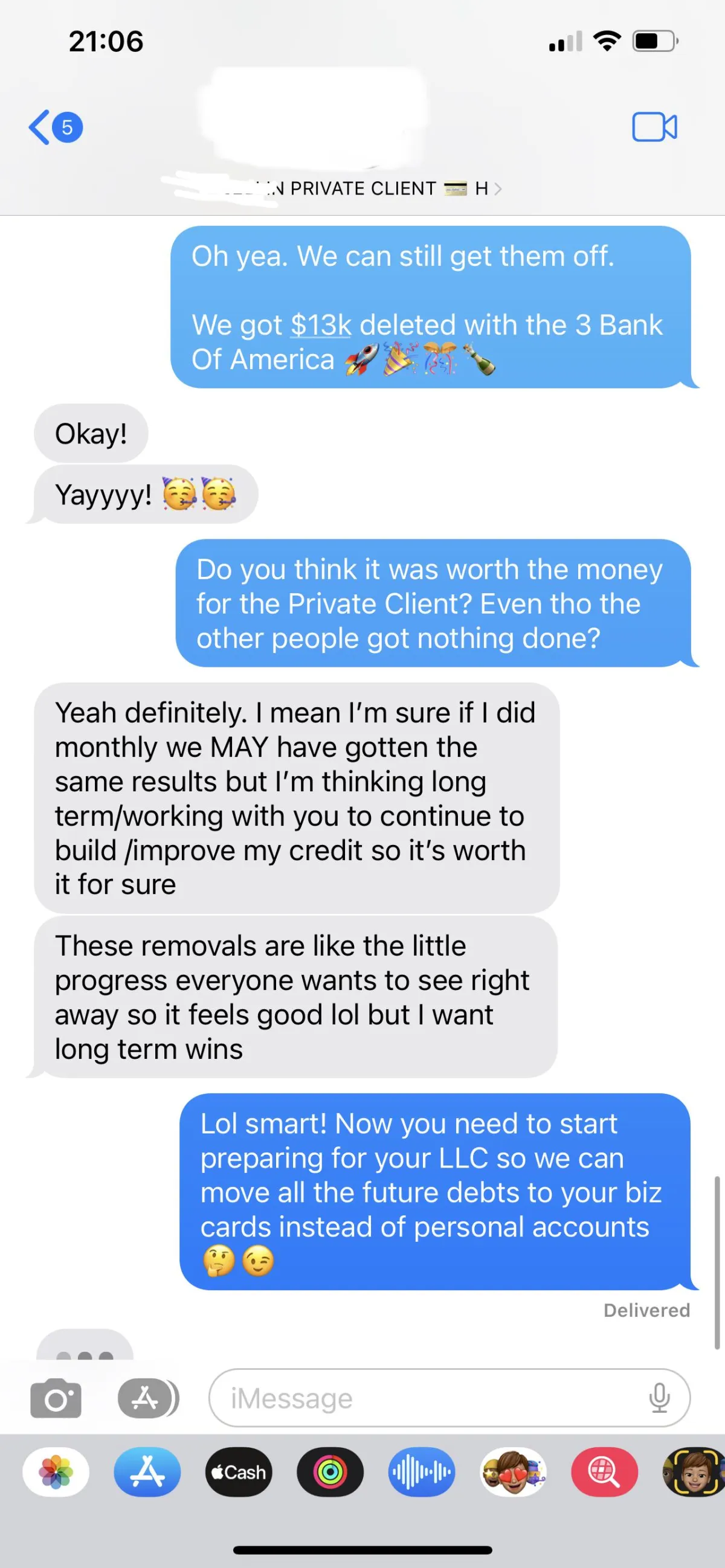

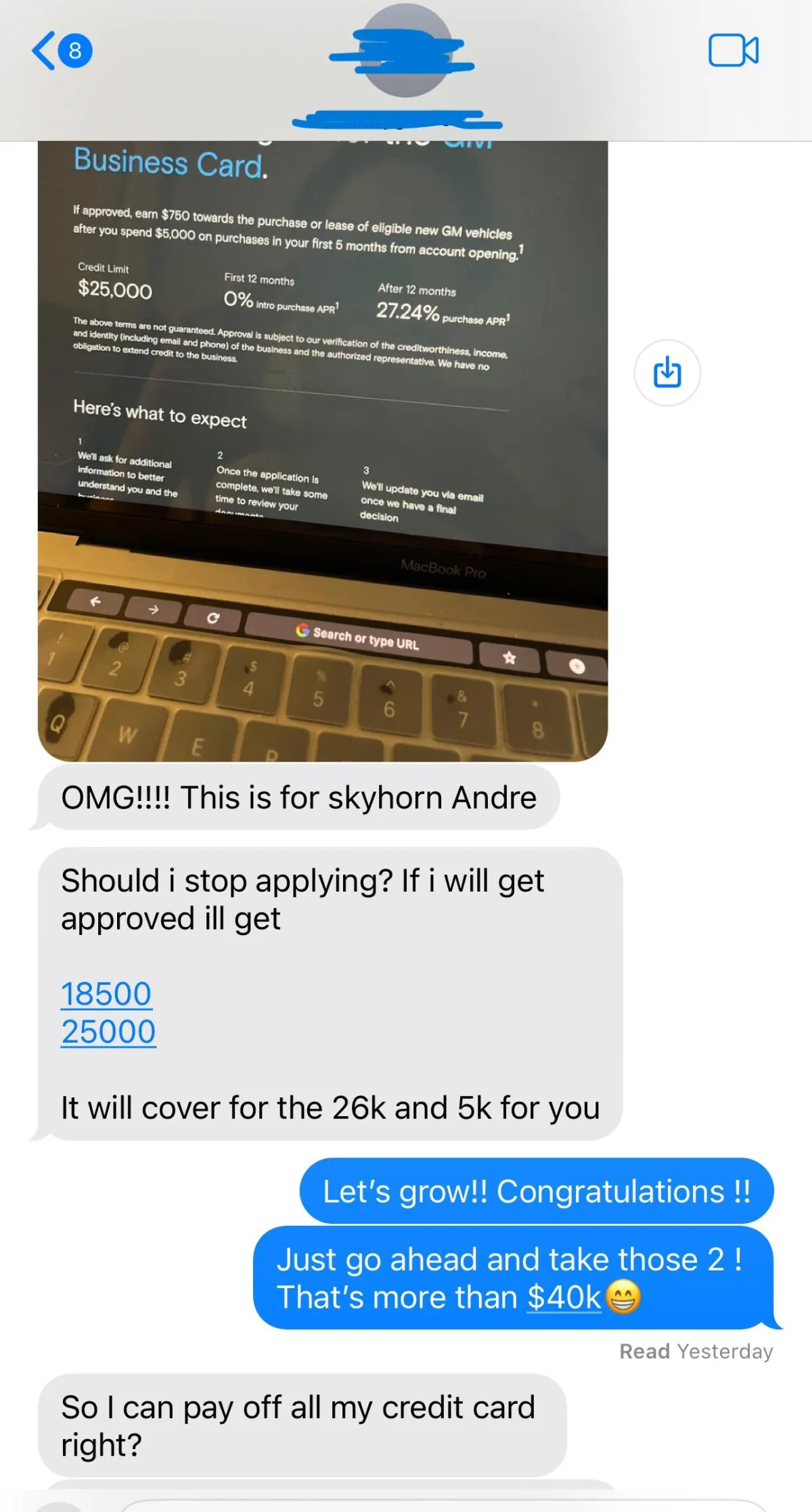

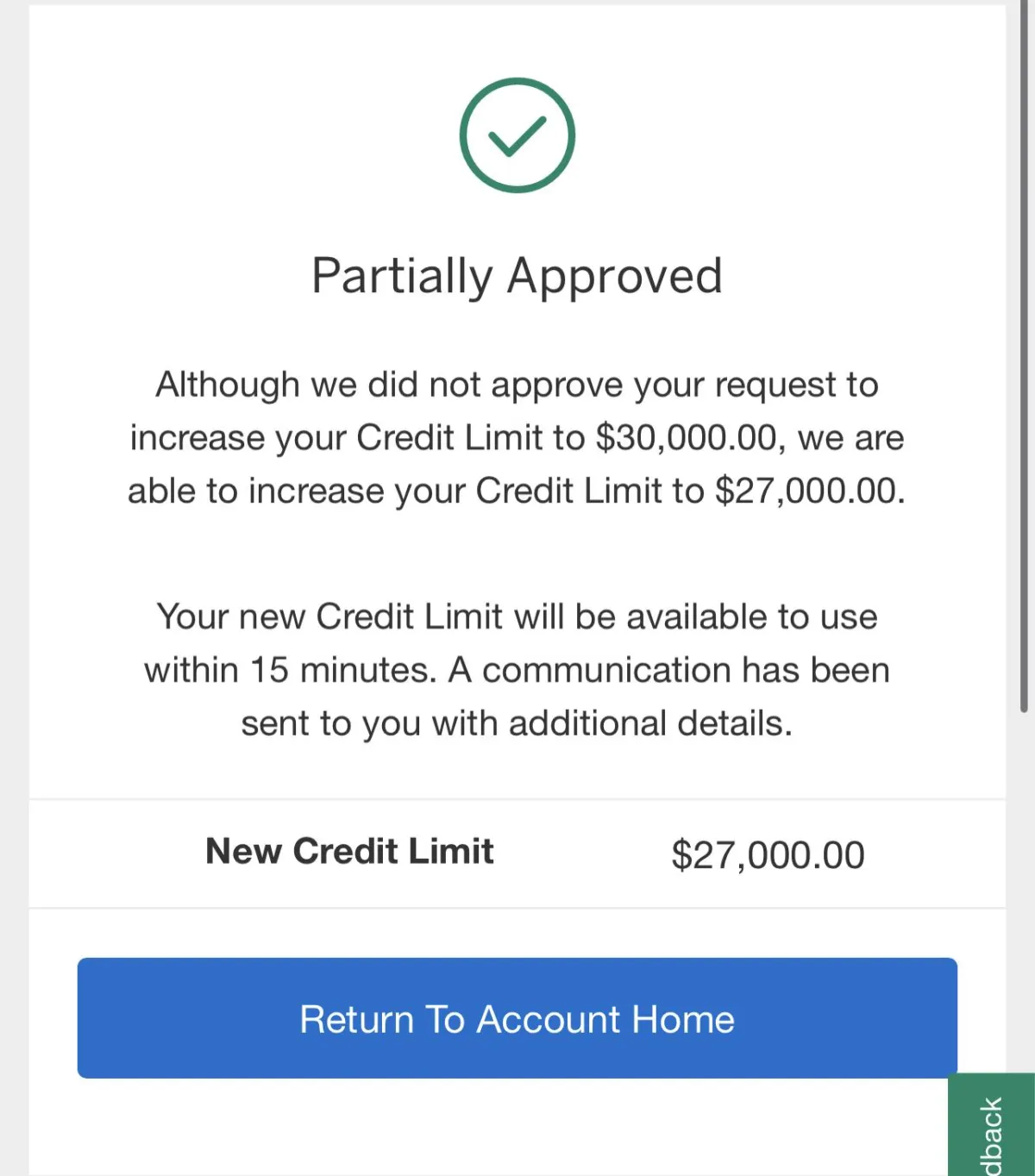

ANGELI AND VERANA

Niche: PHOTO STUDIO

Results: from $0 to $120k in funding

Success Unleashed: Angeli's Journey from $0 to $120K in Available Credit in Less Than 2 Months with Verana

When Angeli sought our assistance, his primary goal was to minimize interest payments on personal loans. We devised a strategy leveraging the advantages of business credit cards and executing a balance transfer to manage his debt effectively.

The Process

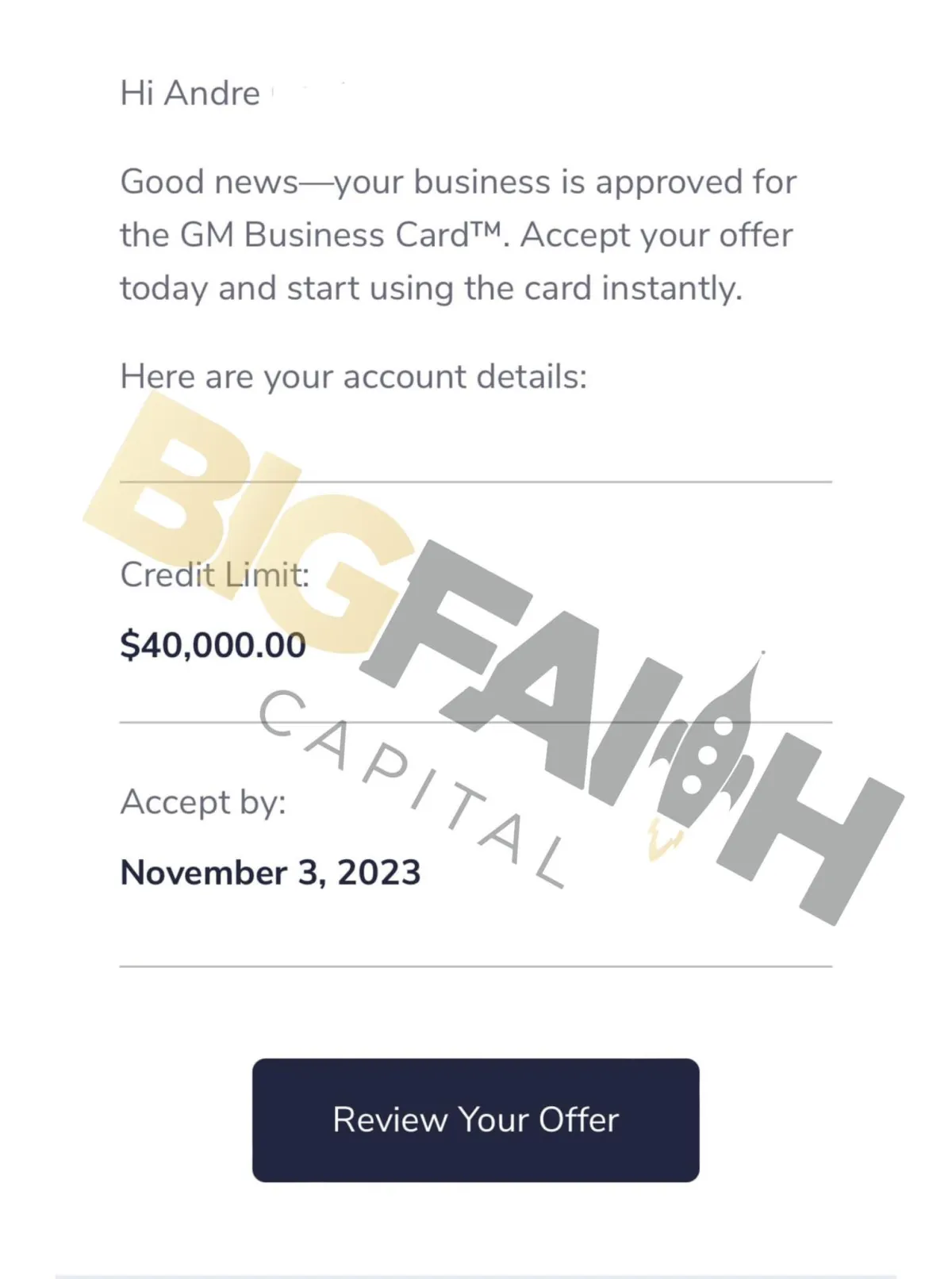

In the initial stages of our collaboration, we provided step-by-step guidance on establishing his business from scratch. This involved filing articles of organization, creating a business pro forma, obtaining an EIN, opening a business bank account, and ultimately successfully applying for business credit cards.

The Result

Our efforts culminated in securing Angeli a substantial $120,000 in 0% APR business credit, even with a brand-new LLC and minimal transactions. This achievement was realized in just 2 weeks, demonstrating the efficiency and effectiveness of our approach

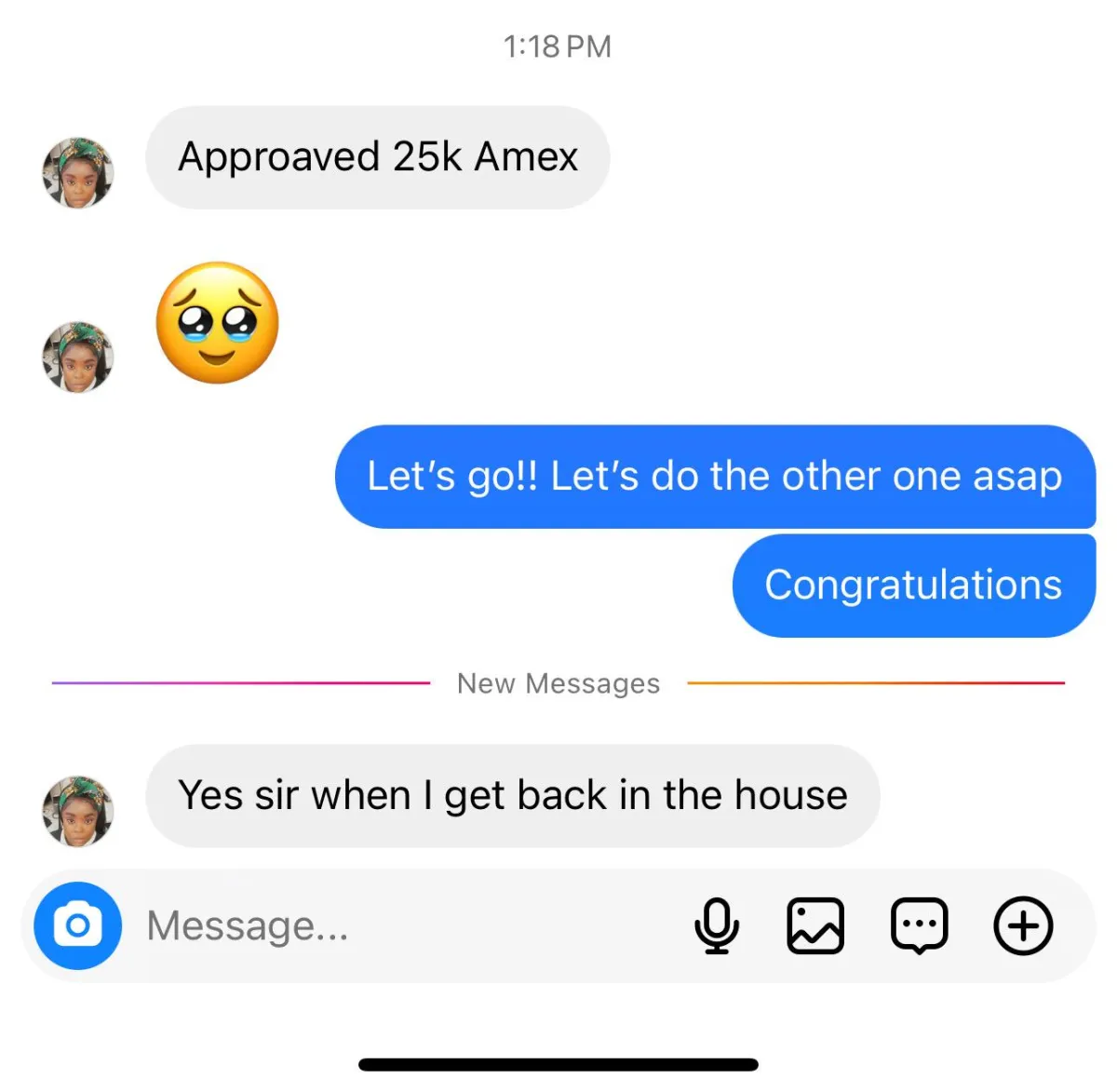

PEOPLE APPROVALS, YOU CAN BE NEXT!